Debt restructuring in Greece is at its final stage. ISDA last night confirmed the credit event. Participation in PSI reached 85% and including CACs will rise to 95%. Many people believed that the Greek stock exchange would rally yesterday but as I mentioned in my Twitter, we should have been more cautious. This does not rule out my view of a rising Greek stock exchange over the next 3-5 months.

I posted on twitter a few days ago a similar chart regarding the General Index. An inverse head and shoulders pattern might be forming and a clear break of the 850 level could push the market much higher. This is my most probable scenario regarding Greek stocks.

I posted on twitter a few days ago a similar chart regarding the General Index. An inverse head and shoulders pattern might be forming and a clear break of the 850 level could push the market much higher. This is my most probable scenario regarding Greek stocks.

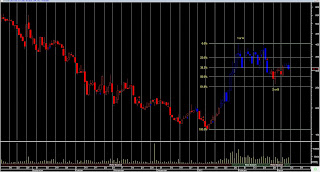

My main focus here is the Greek banking sector in which I see a near 100% return. Stocks like Alpha Bank, National Bank of Greece, Eurobank and Bank of Cyprus, are in my list to see much higher levels. In the chart on your left you can see the banking index moving in a similar way to the General Index. Volume during the Jan-Feb rise has increased dramatically. The rise looks impulsive (5 waves up). The sideways movement reached 61.8% retracement in a corrective form. So this is most probably a wave 2 or at least a B. So what now??? My guess is that we can expect a wave 3(the best case scenario) or at least a C wave up. There are also other options but I don't give them many chances. In the short term things are much more complicated. I favor wave 2 or B has ended but things are not that clear until we see 5 clear waves up. It is important to hold recent lows for the market to advance from these levels. Time will show us the markets intentions. For more info on greek stocks don't hesitate to contact me through this blog or via twitter. Any comment about the analysis or the blog are welcomed.

Hi Alexander

ReplyDeleteaccording to Elliott waves analysis and your general experience, is Athens' FTSE 20 breaking the 307 price level within the week ending March 16?

Thanks,

new PRT reader

PS. comment now posted under relative topic, please delete the one under the most recent blog's post (http://profitablerisktaking.blogspot.com/2012/03/europe-set-to-move-highers.html)

According to elliott waves FTSE20 has made 3 waves up. It is now at 295 area. 294 is an intermediate low that should not break. In a rare case that B is irregular (Fridays high)then 286 (29 Feb low) is the start of an impulsive wave and shoul not be broken. Coming to your question. If FTSE20 holds 286 then we could see 307 again by the end of the week. The market is very volatile, more specifically the banks, and I cannot rule out a close at the end of the week even above 310. Todays session will answer the question if we are in a corrective or impulsive wave.

ReplyDeletePrecious info, thank you

ReplyDeleteAfter today, it is confirmed: ATH FTSE 20 is nothing but trouble :-(

ReplyDeleteDon't dispair....at the times of extreme pessimism you can find a market bottom. Yesterday before close there were signs of a reaction. Today we open much higher without having broken the lows I mentioned yesterday(286 FTSE20). I don't propose buying today, specially at the open!!Market could just be reacting to Fitch announcement and it can easily pull back down.

ReplyDelete