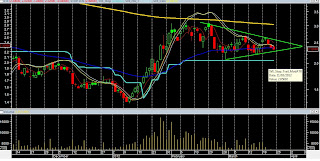

A follower in twitter wanted some info on my view for FTASE 20 and how deep can the correction go. We must first make the assumption that the Jan-Feb rise was wave 1 and we are now in wave 2. Strictly speaking using elliott waves, wave 2 that we are probably in can go all the way to the start of wave 1 but not further. However it is not what happens normally. Usually wave 2s retrace until 61.8% of wave 1. Sometimes they retrace until 76.8%. Emotionally a wave 2 like the one we are experiencing in FTASE20 makes us feel that the previous (downward) trend is resuming. If the waves we are assuming are correct, then I start openning a position at 61,8% but very lightly. I want to see first 5 waves up of any degree. A break of 76.8% in a daily close wouldn't help bulls chances.

Another scenario we have to seriously think is that the rise from January to February is only wave A of a correction (trend remains downwards). Then we would most probably be in wave B. Wave B has made three waves until now and is at 61.8% of wave A. There is no rule that wave B can't go lower than the start of wave A(irregular wave B with extreme downward pressure). After that we would expect an upward wave C.

These two scenarios have 40% chances each imho.

The scenario with the less chances is that the corrective wave started in January and finished in February. So we now resume the downward trend impulsively and we are at the start of a wave 3.

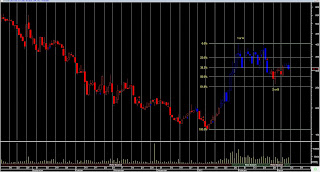

- I see an upward impulsive wave

- when volume increases as prices rise

- when previous highs are broken and higher lows are made